#34 Suppose the European call and put options with strike price

ChemistryExplain is here for you to provide the important questions and answer “#34 Suppose the European call and put options with strike price” this question is coming from Accounting.

Get the Free Online Chemistry Q&A Questions And Answers with explain. To crack any examinations and Interview tests these Chemistry Questions And Answers are very useful. Here we have uploaded the Free Online Chemistry Questions. Here we are also given the all chemistry topic.

ChemistryExplain team has covered all Topics related to inorganic, organic, physical chemistry, and others So, Prepare these Chemistry Questions and Answers with Explanation Pdf.

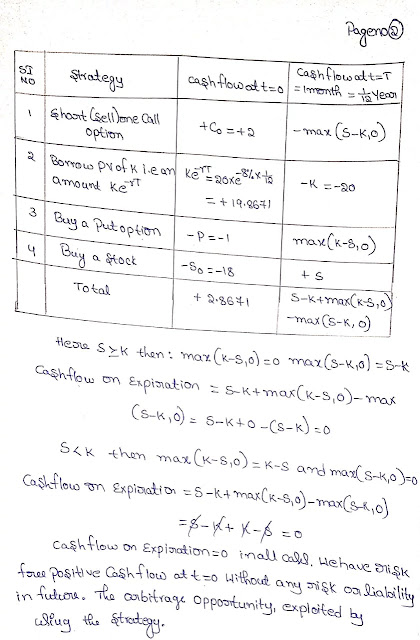

#34 Suppose the European call and put options with strike price $20 and maturity date in 1 month cost $2.0 and $1.0, respectively. The underlying stock price is $18 and the risk-free continuously compounded interest rate is 8%.

(a) Is there an arbitrage opportunity?

(b)If yes, how would you implement arbitrage opportunity?

Get the Free Online Chemistry Q&A Questions And Answers with explain. To crack any examinations and Interview tests these Chemistry Questions And Answers are very useful. Here we have uploaded the Free Online Chemistry Questions. Here we are also given the all chemistry topic.

ChemistryExplain team has covered all Topics related to inorganic, organic, physical chemistry, and others So, Prepare these Chemistry Questions and Answers with Explanation Pdf.

Question

#34 Suppose the European call and put options with strike price $20 and maturity date in 1 month cost $2.0 and $1.0, respectively. The underlying stock price is $18 and the risk-free continuously compounded interest rate is 8%.

(a) Is there an arbitrage opportunity?

(b)If yes, how would you implement arbitrage opportunity?

Answer

Labels: Q&A Other

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home